Some interesting findings in the CyberSource 2006 Online Fraud Report:

- Chargebacks accounted for less than half of fraud losses

- The rate of fraud associated with international orders is twice as high as the overall average

- Merchants reject international orders at a rate three times higher than the overall average

- An estimated $2.8 billion in online revenues was lost to online fraud in 2005; up from $2.6 billion in 2004

- 73% of merchants are engaging in manual order review

- Merchants with less than $5 million in annual online orders have the highest review rate (average 28% of orders)

- Medium and large merchants (merchants selling more than $5 million online) review 15-25% of orders

- Medium and large merchants tend to employ two times the number of screening tools as compared to smaller merchants and are two times as likely to utilize automated decision systems

- 44% of orders reviewed require contacting the customer, 29% require contacting the customer’s bank, and 18% of the orders require contacting third party data sources (such as credit bureaus)

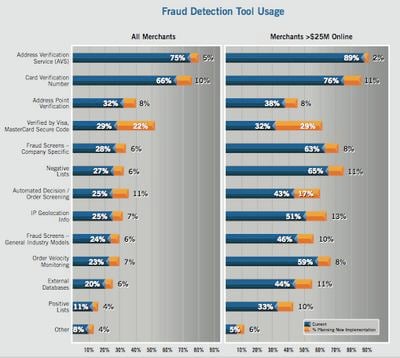

- The most popular forms of automated fraud screening for merchants surveyed included, in order of popularity (also see chart below):

- Address Verification Service (AVS): Compares numeric address data with information on file from the cardholder’s card issuing bank. Generally available for US cardholders and for limited numbers of cardholders in Canada and the UK. Subject to a significant rate of “false positives”.

- Card Verification Number (CVN; also known as CVV2 for Visa, CVC2 for MasterCard, CID for American Express and Discover): Attempts to verify that the person placing the order has the card in their possession in order to provide the additional security digits.

- Address Point Verification

- Card association payer authentication services: Includes “Verified by Visa” and “MasterCard SecureCode”

- Fraud Screens – Company Specific

- Negative Lists

- Automated Order Decisioning / Screening: Helps merchants automate order screening by applying a merchant’s business rules in the real-time evaluation of incoming orders to detect the probability of fraud.

- IP Geolocation Info

- Fraud Screens – General Industry Models

- Order Velocity Monitoring

- External Databases

- Positive Lists

- Merchants surveyed indicated that they ultimately accepted over two-thirds of the orders they manually reviewed

- Merchants rejected 3.9% of orders due to suspicion of fraud

- 21% of merchants reported experiencing a fraudulent order rate exceeding 1% (accepted orders that later turn out to be fraudulent)

- 51% of merchants spend more than 0.5% of their online revenues to manage online payment fraud, while 49% spend less than 0.5%. This cost doesn’t include direct fraud loss (chargebacks, lost goods and associated shipping costs) or the opportunity cost associated with valid order rejection.

- On average, order review staff costs consume 48% of the fraud mitigation budget, followed by 28% for third party tools or services and 24% for internally developed tools and systems.

SIGN UP FOR EXCLUSIVE WEEKLY CONTENT

SIGN UP FOR EXCLUSIVE WEEKLY CONTENT

Great synopsis Stephan. I’d like to know which method works best. Or, is it necessary to use a few methods of fraud screening as a bullet-proof solution?